All Categories

Featured

Table of Contents

- – Exceptional Accredited Investor Investment Ret...

- – Exceptional Accredited Investor Growth Opportu...

- – Elite Accredited Investor Alternative Investm...

- – Esteemed Accredited Investor Alternative Inve...

- – Exceptional Accredited Investor Investment N...

- – High-Value Private Equity For Accredited Inv...

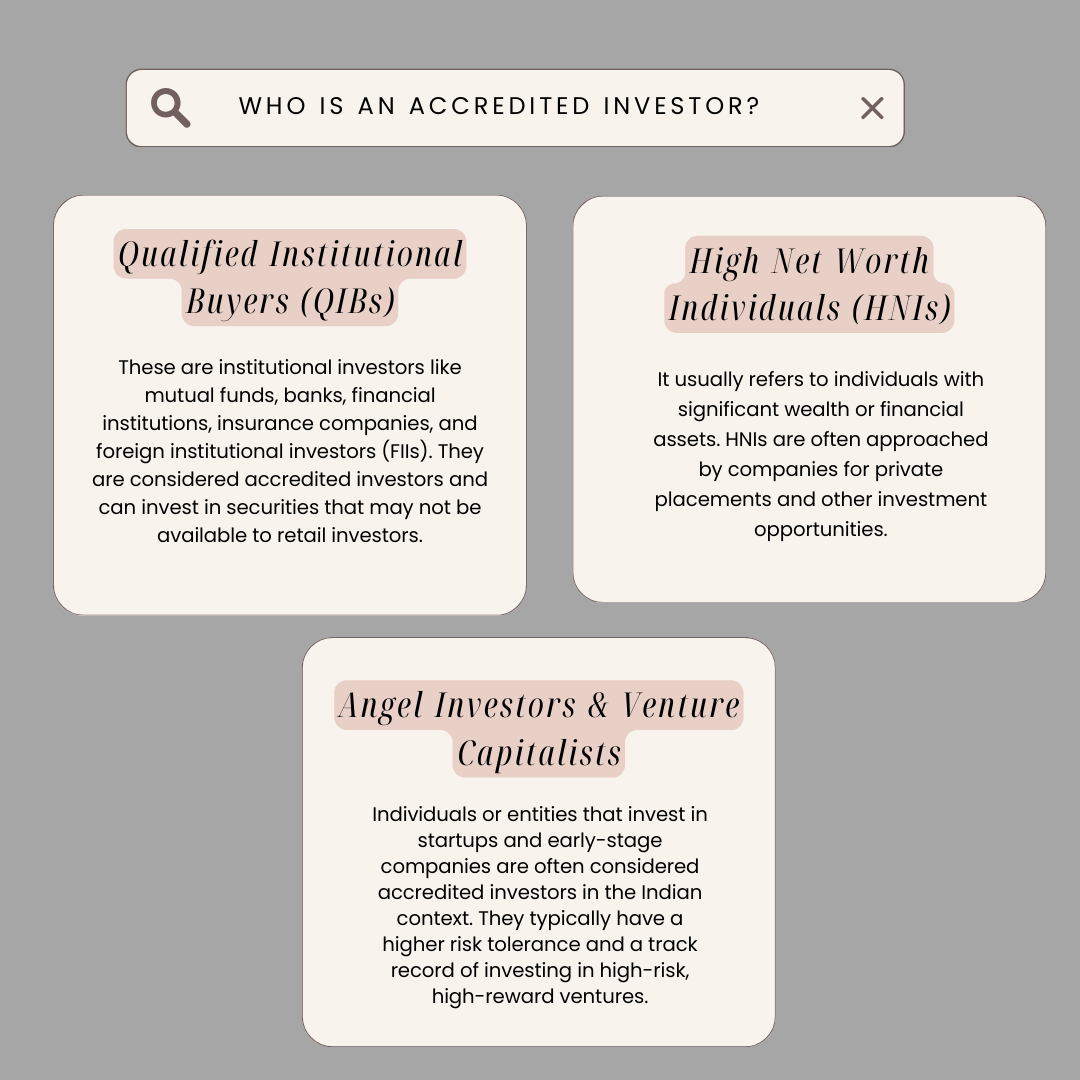

These investors are presumed to have the economic class and experience required to assess and invest in risky investment opportunities hard to reach to non-accredited retail capitalists. In April 2023, Congressman Mike Flooding presented H.R.

Exceptional Accredited Investor Investment Returns

For now, investors must abide should follow term's existing definition. There is no official procedure or government accreditation to end up being an accredited capitalist, a person might self-certify as an accredited investor under present policies if they made more than $200,000 (or $300,000 with a spouse) in each of the previous 2 years and expect the same for the existing year.

Individuals with an energetic Collection 7, 65, or 82 license are likewise taken into consideration to be accredited capitalists. Entities such as companies, collaborations, and depends on can also achieve accredited investor condition if their financial investments are valued at over $5 million. As accredited investors, individuals or entities might take part in exclusive investments that are not signed up with the SEC.

Exceptional Accredited Investor Growth Opportunities

Right here are a couple of to think about. Exclusive Equity (PE) funds have revealed exceptional growth recently, seemingly undeterred by macroeconomic difficulties. In the third quarter of 2023, PE offer quantity went beyond $100 billion, about on the same level with offer activity in Q3 of the previous. PE companies pool capital from certified and institutional investors to get controlling interests in fully grown private firms.

Along with funding, angel capitalists bring their specialist networks, advice, and competence to the startups they back, with the assumption of venture capital-like returns if the company takes off. According to the Center for Venture Research study, the typical angel investment amount in 2022 was about $350,000, with investors getting a typical equity stake of over 9%.

That said, the introduction of online exclusive credit report systems and niche sponsors has actually made the asset course easily accessible to private accredited investors. Today, capitalists with as little as $500 to invest can take benefit of asset-based exclusive debt opportunities, which supply IRRs of approximately 12%. In spite of the rise of ecommerce, physical food store still account for over 80% of grocery sales in the United States, making themand particularly the genuine estate they operate out oflucrative financial investments for recognized investors.

Elite Accredited Investor Alternative Investment Deals

In comparison, unanchored strip facilities and community centers, the next 2 most heavily transacted kinds of realty, videotaped $2.6 billion and $1.7 billion in transactions, respectively, over the same duration. What are grocery store-anchored? Rural strip shopping malls, outlet malls, and other retail centers that feature a significant food store as the area's main tenant generally fall under this group, although shopping malls with enclosed walkways do not.

To a minimal degree, this sensation is likewise true in opposite. This uniquely symbiotic relationship between a facility's renters drives up need and maintains leas elevated. Accredited capitalists can buy these spaces by partnering with realty private equity (REPE) funds. Minimum financial investments commonly start at $50,000, while total (levered) returns range from 12% to 18%.

The market for art is also broadening. By the end of the years, this number is anticipated to approach $100 billion.

Esteemed Accredited Investor Alternative Investment Deals

Capitalists can now possess varied exclusive art funds or purchase art on a fractional basis. These options include financial investment minimums of $10,000 and provide web annualized returns of over 12%. Venture funding (VC) remains to be among the fastest-growing asset classes in the globe. Today, VC funds boast more than $2 trillion in AUM and have actually released greater than $1 trillion into venture-backed startups because 2018including $29.8 billion in Q3 2023 alone.

(SEC).

The needs of who can and that can not be a certified investorand can take part in these opportunitiesare identified by the SEC. There is an usual mistaken belief that a "procedure" exists for a specific to become a certified capitalist.

Exceptional Accredited Investor Investment Networks for Accredited Wealth Opportunities

The worry of showing a person is a certified capitalist falls on the investment lorry instead than the investor. Pros of being a certified financier include access to unique and limited investments, high returns, and raised diversity. Disadvantages of being a certified investor include high risk, high minimal investment amounts, high charges, and illiquidity of the investments.

Guideline 501 of Regulation D of the Stocks Act of 1933 (Reg. D) provides the definition for a recognized investor. Basically, the SEC defines an accredited financier with the boundaries of revenue and total assets in two methods: A natural person with revenue surpassing $200,000 in each of the 2 newest years or joint revenue with a spouse surpassing $300,000 for those years and a practical assumption of the same revenue degree in the present year.

Approximately 14.8% of American Houses certified as Accredited Investors, and those houses controlled roughly $109.5 trillion in wide range in 2023. Measured by the SCF, that was around 78.7% of all exclusive wealth in America. Regulation 501 additionally has stipulations for companies, collaborations, philanthropic organizations, and depends on in addition to firm supervisors, equity proprietors, and banks.

High-Value Private Equity For Accredited Investors

The SEC can add qualifications and classifications going forward to be consisted of as well as motivating the general public to submit proposals for other certifications, designations, or credentials to be thought about. accredited investor funding opportunities. Workers that are considered "knowledgeable workers" of a personal fund are now additionally thought about to be accredited investors in relation to that fund

Individuals who base their credentials on yearly income will likely require to submit income tax return, W-2 types, and other papers that show salaries. People may also take into consideration letters from evaluations by CPAs, tax obligation attorneys, financial investment brokers, or consultants. Recognized capitalist classifications also exist in various other countries and have comparable needs.

In the EU and Norway, as an example, there are 3 examinations to determine if a person is a recognized investor. The first is a qualitative test, an evaluation of the individual's knowledge, expertise, and experience to establish that they are capable of making their own financial investment decisions. The 2nd is a quantitative examination where the individual needs to satisfy 2 of the following requirements: Has actually lugged out deals of significant dimension on the relevant market at an ordinary regularity of 10 per quarter over the previous 4 quartersHas a monetary portfolio going beyond EUR 500,000 Functions or has functioned in the financial market for a minimum of one year Last but not least, the customer has to state in written type that they want to be treated as a specialist client and the company they intend to collaborate with should give notice of the securities they can shed.

Table of Contents

- – Exceptional Accredited Investor Investment Ret...

- – Exceptional Accredited Investor Growth Opportu...

- – Elite Accredited Investor Alternative Investm...

- – Esteemed Accredited Investor Alternative Inve...

- – Exceptional Accredited Investor Investment N...

- – High-Value Private Equity For Accredited Inv...

Latest Posts

Tax Lien Home

Taxes Homes For Sale

Delinquent Properties Near Me

More

Latest Posts

Tax Lien Home

Taxes Homes For Sale

Delinquent Properties Near Me