All Categories

Featured

Table of Contents

You often need to check on your property's residential property values, property tax obligations and residential property title. One of the things you require to focus on is if a tax sale took area between the person that is trying to sell a property to you.

We have actually got some great things we're mosting likely to show to you that a whole lot of individuals ignore in the note service. A little specific niche that they learn about to examine the front end for their very own asset, but they don't often do not consider it in the long run, the longer video game of points.

Great. It is among my very first tasks. Practically two years. We're attempting to see if a tax sale happened in between the person that's attempting to offer it to us and us. If there's a firm name versus the debtor's name on there. It needs to be deeded to the debtor, and if it's deeded to an LLC or an Inc.

5 possibly. We just obtained one for$35,000. I could be choosing $75,000. That's probably mosting likely to take around three months to end up however it remains in the works. I assume we've had an additional $30,000 or $31,000 and I think a $20,000 check and one for $8,000. It ranges $8,000 to $75,000.

Typically in basic, I simply call for the Tax Deeds Division and they're the ones that manage the sale. Each one has actually been different as far as what they titled it, but in general, when I claim tax obligation act sales, every person normally directs me to create a phone number.

Property Tax Not Paid For 10 Years

It's quite personal. It's generally a lawyer or a legal assistant that you'll finish up speaking to. Each county naturally wants various details, but generally, if it's an action, they desire the project chain that you have. Make certain it's recorded. Occasionally they've asked for allonges, it depends. One of the most recent one, we in fact seized so they had actually labelled the act over to us, in that situation we sent the deed over to the paralegal.

The one that we're having to wait 90 days on, they're making certain that no one else comes in and claims on it. delinquent sales tax. They would certainly do further research study, yet they just have that 90-day period to make certain that there are no cases once it's closed out. They process all the documents and ensure whatever's appropriate, after that they'll send out in the checks to us

Then another simply assumed that concerned my head and it's happened as soon as, every currently and after that there's a timeframe before it goes from the tax obligation division to the basic treasury of unclaimed funds. If it's outside a year or 2 years and it hasn't been declared, maybe in the General Treasury Department.

Tax obligation Excess: If you need to retrieve the taxes, take the building back. If it doesn't sell, you can pay redeemer taxes back in and obtain the residential property back in a tidy title.

Once it's approved, they'll say it's going to be two weeks due to the fact that our accounting department has to process it. My preferred one was in Duvall County.

Tax Delinquent Properties For Sale List

Even the areas will certainly inform you. They'll claim, "I'm an attorney. I can load this out." The counties always respond with saying, you do not require an attorney to fill this out - tax foreclosure sales. Anybody can fill it out as long as you're an agent of the company or the proprietor of the residential or commercial property, you can complete the paperwork out.

Florida seems to be rather modern-day regarding just checking them and sending them in. Some want faxes and that's the worst due to the fact that we have to run over to FedEx simply to fax things in. That hasn't held true, that's just happened on two counties that I can believe of.

We have one in Orlando, but it's not out of the 90-day period. It's $32,820 with the excess. It possibly cost like $40,000 in the tax obligation sale, but after they took their tax cash from it, there's about $32,000 delegated declare on it. Tax obligation Excess: A great deal of counties are not going to give you any type of additional information unless you ask for it yet once you ask for it, they're most definitely useful then.

They're not going to provide you any kind of added info or help you. Back to the Duvall county, that's exactly how I obtained into an actually great discussion with the paralegal there.

Land Back Taxes

Yeah. It's about one-page or more web pages. It's never ever a negative day when that takes place. Besides all the details's online since you can simply Google it and most likely to the county site, like we utilize normally. They have the tax obligation deeds and what they paid for it. If they paid $40,000 in the tax sale, there's probably excess in it.

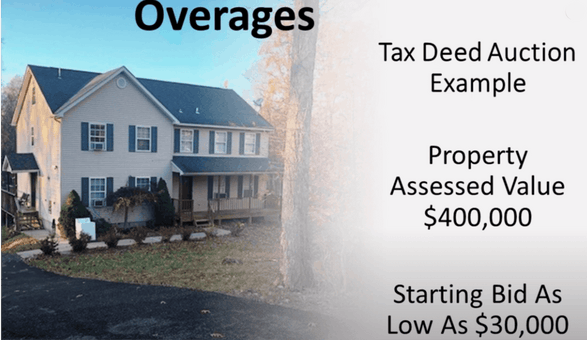

They're not going to let it obtain as well high, they're not going to let it get $40,000 in back tax obligations. Tax Overages: Every area does tax obligation repossessions or does foreclosures of some type, particularly when it comes to building taxes.

As a tax overage service, people search devices are important to finding previous homeowner. Set Search and People Searches are the data tools you'll utilize most. Look all the people on your checklist of unclaimed funds at once. Search individual individuals, their family members, next-door neighbors, and partners. When you have existing call details for the people you browsed, you'll wish to make contact with them and inform them of their unclaimed funds.

Telephone call with unrestricted voicemail, decrease messages, and limitless tape-recorded telephone calls. A Get in touch with Dialer to make contact us to a listing of calls. Certified business text messaging. BellesLink places all the people search devices in one platform which is why it's the choice of several tax excess experts. You can locate contact details for individuals in many areas.

How To Get Tax Lien Properties

These kinds of hands-on searches require time and might not always give current or accurate info. Top tax obligation excess professionals use people browse software application to locate present call info. Individuals search software program allows you to browse big databases of public details that a small company would not have access to differently.

Individuals searches are versatile, you can look on the info you have, such as a name, address, or phone number. To do a deeper search for the full get in touch with details on an individual, you can additionally search their relatives, neighbors, and affiliates. Individuals searches makes it faster and much more cost effective to obtain precise contact information, including mobile phone numbers, addresses, and emails, for a checklist of people with unclaimed funds.

Tax Lien Foreclosed Properties

People searches makes it quicker and a lot more affordable to get precise contact details. If the contact information they get from their search is out of day or just simple wrong, that service is going to lose a lot of time and money calling the wrong people or sending by mail to the wrong addresses.

Latest Posts

Tax Lien Home

Taxes Homes For Sale

Delinquent Properties Near Me